There are a huge number of mortgages available, and the choice can sometimes be overwhelming.

From fixed and variable rate deals to capital repayment and interest-only mortgages, choosing the right mortgage for you can be daunting.

One type of mortgage you may have heard of is a tracker mortgage and in this guide we explain everything you need to know about how trackers work and how they compare with the more common fixed rate deals.

What is a tracker mortgage?

A tracker mortgage is a type of variable rate mortgage.

This means the interest rate you pay on your mortgage can change at any time and so can you monthly repayments.

Other types of variable rate mortgage include:

Standard variable rate (SVR) mortgages

Each mortgage lender has their own Standard Variable Rate (SVR), which can change at any time.

If you have a particular mortgage deal, for example a fixed rate or a tracker, you normally move on to your lender’s SVR when that deal expires.

Discounted rate mortgages

Discounted rate mortgages offer you an interest rate that is discounted from your lender’s Standard Variable Rate (SVR) for a fixed period of time.

For example, if you are offered a 1% discounted rate mortgage for two years and your lender’s SVR is 4.5%, the interest rate you pay at the start of the term will be 3.5%.

However, as your lender’s SVR can change at any time, the interest rate you pay and your monthly repayments can also change.

How do tracker mortgages work?

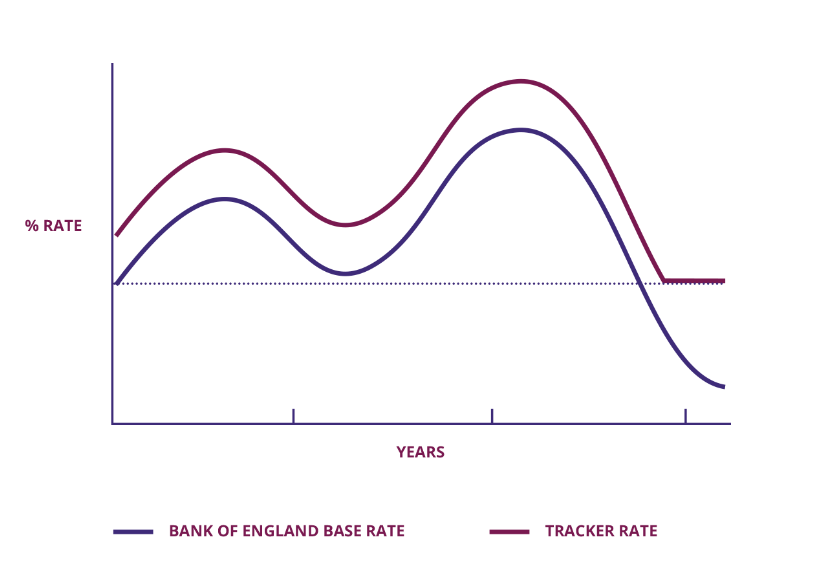

Trackers relate to the Bank of England’s base interest rate and ‘track’ it – meaning if the base rate goes up, your interest rate goes up.

Equally, if the base rate falls, your interest rate falls, too.

For example, if your tracker mortgage was a +1% deal for two years, the rate you pay would be 1% higher than the Bank’s base rate.

So, if the base rate was 3%, you’d pay an interest rate of 4%.

But if the base rate were to go up to 3.5%, your interest rate would rise to 4.5%.

Alternatively, if the base rate were to fall to 2%, your interest rate would fall alongside it to 3%.

Tracker ‘collars’ and ‘caps’

When looking for suitable tracker mortgages, you’ll need to consider ‘collars’ and ‘caps’.

Tracker rate collars are also known as floors and are the minimum rate your tracker can reduce to.

For example, if you have a tracker mortgage that comes with a collar of 1%, your interest can’t fall below that figure – even if the Bank of England base rate falls.

‘Caps’, meanwhile, are the maximum rate you’ll pay even if the base rate goes higher.

The best tracker rates often come with a collar, while the highest tracker rates sometimes come with a cap, so be aware of these factors.

If you were to pick a tracker with a collar set at your introductory rate, you wouldn’t ever benefit from any fall in the Bank’s base rate but will pay more if that rate rises.

Tracker mortgage early repayment penalties

Many tracker mortgages come with lower early repayment charges (ERCs) and some come with no ERCs at all.

This means a tracker could be a good option if you’re thinking of moving during the introductory term of your deal as you’ll pay a smaller ERC than a fixed rate deal or sometimes no ERC at all.

Equally, if you want to switch to a different mortgage deal, you may be able to do so without any ERCs.

However, because trackers are variable, your mortgage payments could go up or down at any point during your deal.

What happens when a tracker mortgage ends?

Trackers are usually offered for two-to-five years and after your deal is up, you’ll move on to your lender’s Standard Variable Rate (SVR).

This usually means your mortgage payments would go up, so you would need to decide if you wished to remortgage with your current lender or a new lender to secure a cheaper interest rate.

Are tracker mortgages cheaper than fixed rates?

Tracker mortgage interest rates are usually cheaper than fixed rates – but don’t always stay that way.

Fixed rates are often more expensive initially because you’re paying for the security of having fixed mortgage repayments for a set period of time.

But because trackers rates can change in line with the Bank of England base rate, you could end up paying a higher rate than a fixed deal if the base rate were to rise.

However, if the base rate were to fall, you would end up paying less than if you were on a fixed rate.

And because trackers usually come with smaller or no early repayment charges (ERCs), they offer more flexibility than fixed rates if you wish to move home or switch mortgages during your deal.

As many as 6.3million homes in the UK are estimated to be on a fixed rate mortgage – around 75%.

But trackers are among the most popular variable rate deals as they reflect the Bank’s base rate rather than Standard Variable Rates (SVRs), which can be put up by a lender at any time.

As of November 2022, there were just over 1,400 fixed rate deals available in the UK, with more than 230 variable rate mortgage products, including trackers.

The pros and cons of a tracker mortgage

Like all mortgages, trackers come with several pros and cons you’ll need to consider…

Tracker pros

- Tracker interest rates fall if the Bank of England base rate falls

- Trackers with caps mean your interest rate can’t go higher than a certain percentage

- Trackers with collars often come with lower introductory rates

- Many trackers come with small or no early repayment charges (ERCs), giving you flexibility

Tracker cons

- Tracker interest rates rise if the Bank of England base rate rises

- Trackers with caps are rare and often mean paying a higher introductory rate

- Trackers with collars set at the introductory rate mean you’ll never benefit from any base rate fall

- If you choose a tracker with early repayment charges (ERCs) you may have to pay to end your deal early or move home

Should I get a tracker mortgage?

Whether a tracker mortgage is the right deal for you will depend on your personal circumstances and whether you prefer the security of fixed mortgage payments or the flexibility of small or no early repayment charges (ERCs) offered by many trackers.

Trackers usually come with cheaper introductory rates compared with fixed rate mortgages, too, meaning you could pay less interest on your loan.

But that benefit is offset by the fact that if the Bank of England base rate were to rise, your payments would also go up.