If you’re new to letting or a seasoned investor looking to expand your portfolio, you should fully understand rental yield.

To help you to calculate the rental yield for a property and understand the difference between a good yield and a bad one, we’ve created this simple guide.

Remember, your local Martin & Co agent can help you to get the most out of your investment. Get in touch with your local branch today.

What is a rental yield?

The term ‘rental yield’ refers to how much money you can expect to make from your initial investment from rental income. This is often shown as a percentage of the market value of the initial investment. While yields can be calculated for any period, it is most common to use annual yields.

Landlords and investors use rental yield to monitor the value of their property. After all, the fluctuating housing market, property prices, interest rates and growth in demand can all have an effect on rental yields.

Why do rental yields matter?

A good return on investment (ROI) is important when investing in a buy-to-let property. Before they make a purchase, investors should work out what to charge for rent to make the investment worthwhile.

If you spend more than you can make, or if you just manage to break even, something as seemingly trivial as a boiler repair could leave you out of pocket.

Related: Five things no one tells you about investing in property

What’s the difference between gross and net rental yield?

The difference between gross and net rental yields is important to consider when doing your calculations. Here’s a simple way to understand the two:

Gross rental yield

The gross rental yield is everything before expenses. This is calculated using the price of the property and the income generated by the property.

Net rental yield

The net rental yield is everything after expenses. It is calculated using the price of the property, the income generated by the property and the associated costs and fees of owning a property.

How to calculate your rental yield

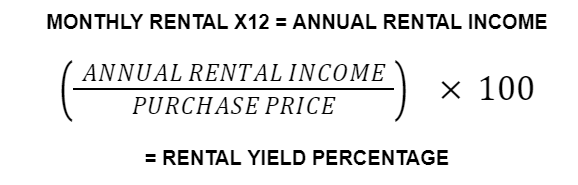

- Step one: Multiply your monthly rental income by 12 to get the annual figure.

- Step two: Divide that figure by the property’s purchase price.

- Step three: Multiply that figure by 100 to get your gross rental yield percentage.

If you have yet to buy your property, use the current market value and your anticipated rental income to determine your yields. If your rent is paid weekly, multiply the figure by 52 to get your annual rental income.

You can also use online calculators to get an accurate figure for your rental yield. Ask your local Martin & Co agent for more information.

What counts as a good rental yield?

There are no hard and fast rules when it comes to weighing up what counts as a good rental yield. As a general rule, a gross rental yield between 5-6% might be considered ‘good’ and above 7% ‘very good’.

How can I maximise my rental yield?

The property market is always in a state of fluctuation, so a property’s rental yield often varies depending on external factors. However, there are a few things you can do to get the most out of your rental yield:

Adjust the rent

If your current rental price is lower than the local market rate, you may be able to increase it if your tenancy agreement allows. Conversely, if the rent is higher than other properties in the area, reducing it slightly could increase demand for your property and lower your void periods.

Assess your outgoings

Making a few simple changes to your property outgoings could lead to big savings in the long run. Whether this means remortgaging to find a better deal, or working with a letting agent to carry out maintenance, cutting down on unnecessary expenses can make a big difference when it comes to maximising your rental yield.

Keep up to date with regulations

Part of being a responsible landlord includes keeping on top of current health and safety regulations. A letting agent can manage the maintenance and legal compliance of the home, which can result in long-term tenancies and a great reputation for your property.

Contact the dedicated lettings team at Martin & Co for more information.