With the current Stamp Duty cuts in place due to end on March 31, 2025, you may be considering investing in a buy-to-let (BTL) property sooner rather than later.

However, you may be wondering if there are any restrictions in place for landlords looking to invest. Should you purchase properties within a certain price range? Does it matter how many properties you already own?

In this guide we’ll run through everything you need to know about how to avoid paying Stamp Duty Land Tax (SDLT) on your next investment.

Take a look at our latest investment properties

Do the Stamp Duty cuts apply to Buy to Let properties?

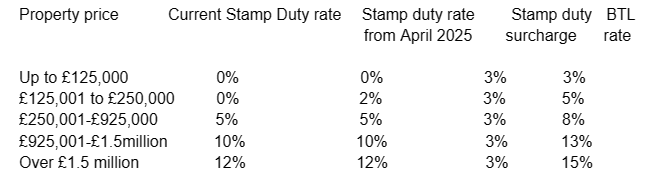

Yes, landlords can benefit from the Stamp Duty cuts, although they must still pay the additional 3% Stamp Duty surcharge on any property purchase. There are some limitations to the cuts for BTLs, but if your property costs less than £250,000, the same Stamp Duty rates will apply.

How much is Stamp Duty?

Related: Stamp Duty questions answered

What types of properties does Stamp Duty apply to?

SDLT applies to freehold properties, new and existing leaseholds, and properties purchased through shared ownership schemes.

If you already own a property, do you have to pay a Stamp Duty surcharge?

If you are an existing homeowner, you will pay a SDLT surcharge on any secondary property purchases, whether that’s a holiday home or a buy-to-let property. Essentially, you add 3% to the applicable Stamp Duty rate.

When don’t you have to pay a Stamp Duty surcharge?

If you purchase a second property valued at less than £40,000 or a home, such as a houseboat, then you will not have to pay Stamp Duty. You may also be entitled to a refund if you sell your current property within 18 months of purchasing your secondary property.

Can I invest in property if I’m a first-time buyer?

Currently, first-time buyers can spend up to £425,000 before having to pay Stamp Duty and 5% up to the value of £625,000. From April 2025, you will pay 5% on properties valued from £300,001 to £500,000. However, if you are letting out the property, you will not qualify for first-time buyer exemptions.

Can you avoid paying Stamp Duty?

If you are unmarried, you could put the second property in your partner’s name if they do not have a property in their name already. This does not apply to married couples, as they are regarded as one person. You may also consider putting the property in a family member’s name.

What if you don’t already own a property?

If you do not currently own a home and you are planning on investing in the buy-to-let market, then you will not pay SDLT up to the value of £250,000. However, you will still pay the SDLT surcharge.

Are you looking for a good investment?

Overseas buyers

If you are an overseas investor and do not have a main residence in the UK but do own another property abroad, then you will have to pay SDLT. If you want to buy a property abroad, you will not pay a SDLT surcharge as long as you own one property in the UK.

How do you pay Stamp Duty?

You can add the cost of Stamp Duty to your buy-to-let mortgage. The HMRC stipulates that you have 14 days to send a Stamp Duty return from the day of completion. Your solicitor or conveyancer can take care of this for you.

Find your perfect buy-to-let property and explore managed lettings’ packages with Martin & Co